By now you’ve heard about our work and you’re here to align your operations with “All Applicable Laws” in your industry. Answer the following questions and we will reach out to your Person of Contact typically within 2-3 business days tops.

HOW MUCH WILL THIS COST?

We charge administrative fees upfront while we perform our Consumer claim processing service on credit. Our professional audit and research team has already performed the work necessary to prepare and file most claims quickly.

Once we have collected your documents, identified the claims you can make, and receive your authorization to administer them, we will advise you of our expected time frames.

Our pricing stays low and flexible so we can be a reliable resource for your administrative needs. Call us at 888-899-9372 for more information on how we do business and provide Consumer Services.

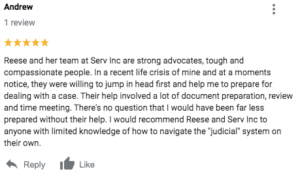

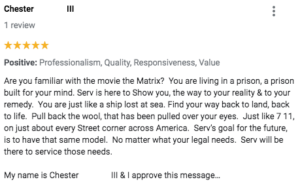

WHAT CLIENTS SAY ABOUT US

About Serv

Our Story

We are Serv Inc., and we believe when we Serv together, then we Soar together. As your company expands, grows market share, and continues to add jobs to the economy, you also have the responsibility to share your success with not only your employees but the community that you serve. We are here to assist you in a sustainability plan that will positively affect the way your team works together to increase revenue while serving the very people that help you reach success.

We are Serv Inc., and we believe when we Serv together, then we Soar together. As your company expands, grows market share, and continues to add jobs to the economy, you also have the responsibility to share your success with not only your employees but the community that you serve. We are here to assist you in a sustainability plan that will positively affect the way your team works together to increase revenue while serving the very people that help you reach success.